AHCU Blog

Welcome to the AHCU Blog, your go-to source for trusted financial tips and advice. We’re here to help you grow your money and achieve financial wellness so you can achieve your goals.

How to Spot and Avoid a Romance Scam

When Romance Turns Into a Scam: What to Watch For When your schedule runs on 12-hour shifts and rotating weekends, meeting someone the traditional way isn't always realistic. Dating apps and social media can feel like the only options that fit your life. Romance...

How Healthcare Workers Can Ease Financial Stress in Uncertain Times

Simple Financial Moves That Can Help Lighten the Load. Financial stress can slip in between shifts, paperwork, and everything else that keeps your day running. And with economic headlines changing week to week, that background tension can build fast. Small,...

New Year, New Financial Wellness Goals

Here are five tips for healthcare professionals for when you set your financial goals for the coming year.

Do Not Get Tricked by an Online Job Search Scam

Make sure your job search doesn’t turn into a costly scam. Read these tips for to identify a job search scam.

When Should You Start Investing

When to start investing – here are some strategies to successfully plant the seeds of wealth for a brighter financial future.

Do You Know How Your Payment Cards Work When You Travel?

Save more when you travel by knowing the right card card – or cash- to use and when. Planning ahead can save big money on travel transactions.

Protect Your Computer from Becoming Part of a Botnet

Is there a zombie in your house? Learn how to protect your computer from becoming part of a botnet, and what exactly this means.

Are You Considering an Early 401(K) Withdrawal?

If you are considering an early 401(K) withdrawal, take the time to educate yourself about how this will impact your financial health in the long term.

Getting Married? Time to Talk Financial Goals

Getting married is a team effort. It’s important to talk about finances well ahead of your wedding day.

How Credit Score Affects Your Home Buying Power

Your credit score affects your home buying power, since it tells lenders the odss you’ll make your loan payment

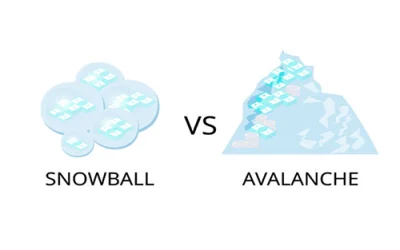

Paying Off Debt: Snowball vs. Avalanche

There are two common methods to help stay focused on paying off debt, the snowball and the avalanche.

Cyber Crooks and Retirement Accounts

Cyber crooks and retirement accounts are a scary combo, since people seldom check the balance in these accounts.

Avoiding “Regretful” Financial Decisions

Regretful financial decisions come with have long-term consequences. Here are some tips for avoiding them.

How Our Beliefs About Money Affect Our Goals

Your beliefs about money impact your financial goals, and can make you your own worst enemy.

Splurge Accounts Can Help with Impulse Spending

Impulse spending can destroy even the most carefully laid out budget. Here are some tips to work around it.

Holiday Spending: Avoiding Surprises

Agree on your holiday spending budget ahead of time to avoid ugly surprises later.

Money Saving Ideas

Day-to-day spending decisions can have a big impact on your financial health. Here are some money saving ideas and suggestions that add up over time.

Dealing with Inflation

There are some strategies you can take when dealing with inflation. Ask for a raise, cut back on some perks, and call us when you need help for the long term.

Making Sense of Your Budget

Making sense of your budget means knowing when to revisit your spending decisions. Review your financial lifestyle after every major life event to make sure your goals and your savings are in sync.

Nudging Yourself Toward Your Goals

If you need help nudging yourself toward your goals, set up an accountability system to maximize your chances for financial success.

Fundamentals of Investing

Here are some fundamentals of investing to help you invest your money wisely and secure your future financial independence.

Borrowing for Graduate School

Grad school can be a great way to advance your career, but borrowing for graduate school and establishing a repayment strategy should be part of the equation.

Managing Student Loan Debt

If you’re having trouble managing your student loan debt, there are options to help you reduce your monthly payment. With federal loans, you can change your repayment plan at any time.

Financial Procrastination Has a Cost

Financial procrastination has a cost. If you defer making necessary financial decisions such as cashing checks or paying bills on time – the costs tend to be substantial and long-lasting.

How to Raise a Saver

Instilling good savings habits in children is a critical first step in preparing them for later financial success. Follow this advice on how to raise a saver.

How to survive a personal financial crisis

How to survive a personal financial crisis. By following the steps outlined above, you improve your odds of emerging from this financial crucible unscathed – and, perhaps, even healthier and stronger.