Sometimes paying off debt can feel impossible especially if you owe a lot, so what can you do?

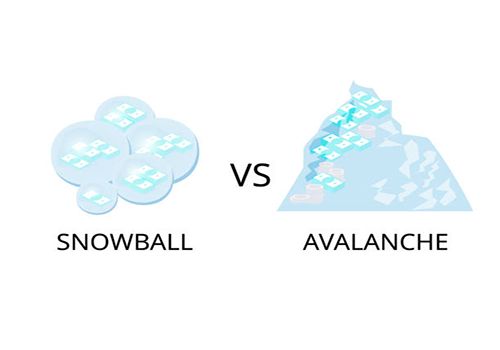

There are two common methods to help stay focused on clearing debt, the snowball and the avalanche. Let's start with the snowball method.

First, list all your debts, such as credit cards, bills, and loans from the lowest to highest amounts. Next, make the minimum monthly payment on each bill using any extra money you have towards clearing the total balance of the lowest bill. As you roll your payments from the smallest balance to the next one on your list the amount you can pay snowballs giving you more funds to pay down the bigger debts.

Now, on the avalanche method, this method is simply just list and pay your debts from those with the highest interest rates to the lowest. This way you can slide your way down the debt mountain saving money in the long run because you're paying off high-interest debt first while still making minimum monthly payments on the others.

So, which method is better? Well, that's up to you. The snowball strategy can be encouraging because you'll see debts getting paid quickly. While the avalanche attack can save money by paying less in interest costs over time.

Ultimately either method can help you stay focused on paying off all your debt, now wouldn't that be cool?