Auto Loans and More

Personalized Lending Solutions Just for You

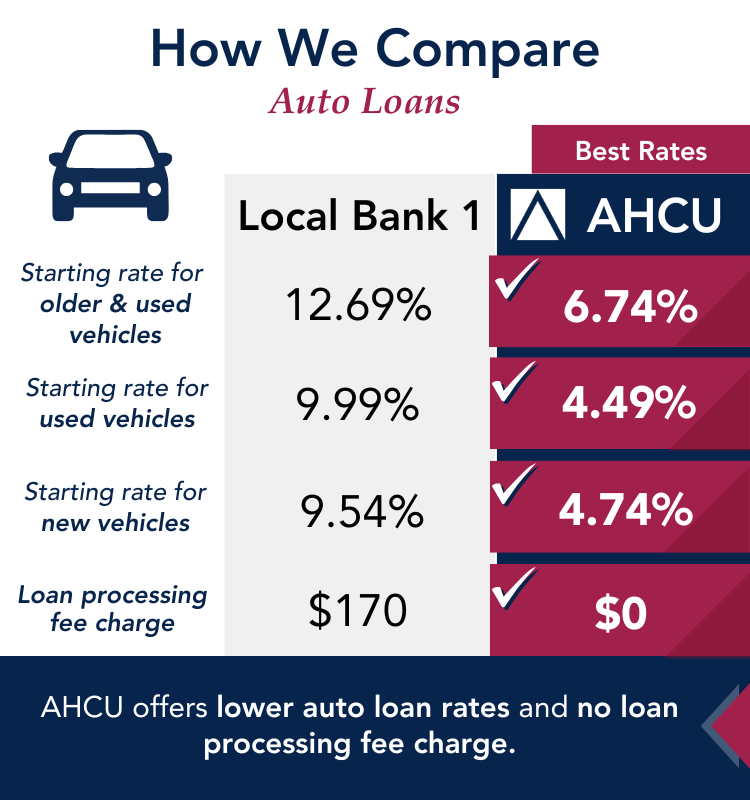

We offer a wide range of lending services and, as a not-for-profit financial institution, provide lower rates and fewer fees. Our compassionate approach means we're here to support you on your financial journey, helping you save money along the way.

Manage your loan information and make payments effortlessly through Online Banking or Mobile Banking.

If you are a current member, you can simply log into online banking, click (+) add account and choose Apply for a Loan.

Types of Personal Loans

New & Used Auto Loans

AHCU offers competitive rates on both new and used vehicles, with up to 125% financing (including taxes and license) for qualified buyers. When you apply, the decision-making process is quick and local.

Even if you don't have your new wheels picked out yet, we encourage you to apply for pre-approval. It's free and gives you extra bargaining power at the dealership.

Already have a car loan? Refinance your current vehicle to potentially lower your rate. We have a wide range of terms customized to your unique situation.

RV Loans

- Motorhomes

- ATVs and small 4-wheelers

- Snowmobiles

- Campers

- And more!

Why get your loan through AHCU?

- Flexible repayment terms

- Up to 125% financing available on all purchases

- Free pre-approval for extra buying power when negotiating

- Prompt, local decision-making and processing

- Customized, friendly service from our experienced lending team

Already have a loan? Refinance your vehicle to potentially lower your rate. We have a wide range of terms customized to your unique situation.

Boat Loans

- Competitive rates for new or used boats

- Includes sailboats and motorboats

- Refinance to potentially lower your current rate

- Financing also available for a variety of RVs, including jet skis

- Flexible repayment terms

- Up to 125% financing (including taxes and license) available on all purchases

- Free pre-approval for extra buying power when negotiating

- Prompt, local decision-making and processing

- Customized, friendly service from our experienced lending team

And More!

Our Signature loan is a personal loan that can be used for any purpose, such as vacation, taxes, personal computers, tuition assistance and more.

- Maximum loan amount is generally $10,000

- Maximum financing is 60 months; term is based on amount borrowed

- Loan amount is based on credit score and key ratios (debt to income & unsecured debt to income)

- Low-cost Credit Life and Disability Protection available

When applying online for a personal loan, select the option for Unsecured Credit.

Integrity Autosource

Your Personal Auto Shopper

At AHCU, we're dedicated to making your car-buying experience smooth and enjoyable. That’s why we've partnered with Integrity Autosource for a convenient “Personal Shopper” auto-buying service.

Trusted Concierge Service

For over two decades, Integrity Autosource has been helping AHCU members find the perfect vehicle. Our team members and their families can attest to the value and convenience of this concierge service.

Any Make, Any Model, New or Used

Simply call Brett Broghammer at (651) 426-6411, and after a quick 10-minute chat, he and his team will search nationwide for your ideal car. Once found, the car is detailed, thoroughly inspected, and any necessary repairs are completed. You’re then invited for a test drive. If you love it, it’s yours—if not, there’s no obligation to buy.

Start Your Journey

Call Integrity Autosource at (651) 426-6411 today or visit Integrity Autosource online. Let them know AHCU sent you! And remember to work with AHCU to secure the best rates and terms for financing your vehicle.

* Integrity Autosource, which is located at 3625 Talmage Circle, Vadnais Heights, MN 55110 is not owned or operated by Associated Healthcare Credit Union

Protect Your Wheels!

Buying a vehicle is just the beginning. If you have a new vehicle, it starts losing value as soon as you drive off the lot. Consider GAP Protection to cover the value of your loan.

We also offer extended warranty plans - especially apt for used vehicles. And our TruStage affiliate offers great prices on traditional auto insurance coverate.

GAP Insurance

If you owe more on your vehicle than its current current market value, consider buying GAP (Guaranteed Asset Protection) Insurance. If your vehicle is totaled or stolen, GAP insurance pays the difference between the value of the vehicle (as determined by the insurance company) and the unpaid balance of the loan.

What is the gap on your vehicle? You may be surprised at the answer!

GAP Advantage

The GAP Advantage gives you further peace of mind. If the vehicle you are now purchasing ever becomes "totaled" or is stolen and not recovered, GAP Advantage pays an additional $1,000.00 toward the purchase or lease of a replacement vehicle. Not only will you receive the difference between the value of your vehicle and its unpaid loan or lease balance, you also get a head start on financing or leasing a new or used replacement vehicle.

Route 66 Auto Warranties

While engines and transmissions are more reliable than ever, vehicles today contain high-tech sensors, electronics, and computers that frequently fail. As vehicles become increasingly more complex, associated repair costs rise dramatically.

No matter where you travel in the United States, we protect you against major mechanical expenses, and there is NO DEDUCTIBLE on covered parts or labor.

Mechanical Breakdown Protection (MBP)

MBP reduces out-of-pocket expenses when your vehicle suffers an unexpected mechanical failure and provides peace of mind for worry-free driving!

MBP Benefits:

- Nationwide Protection

- 24-Hour Roadside Assistance for the term of your coverage

- Rental Vehicle Assistance

- Transferable Coverage if you sell your vehicle before your agreement expires

Easy Street: Factory Type Coverage

The Easy Street Plan is designed for vehicles that are 6 model years old or newer that have 85,000 or less odometer miles. The Easy Street Plan extends coverage to virtually all mechanical and electrical components of your vehicle unless the part is specifically listed as not covered.

Easty Street Benefits:

- Rental car allowance

- Towing

- Flat tire assistance

- Gasoline and fuel delivery

- Lock-out service

Older Vehicle Coverage

We have two plans designed for vehicles that are 9 model years old or newer and have 140,000 miles or less on the odometer.

Main Street Deluxe Coverage is an extended warranty covering all major vehicle systems including the following: Engine, Transmission/Transfer Case, Drive Axle, Electrical, Brake, Suspension, Fuel, Steering, Air Conditioning, and various Hardware.

First Street Coverage provides named component coverage for the drive-train systems of your vehicle including the Engine, Transmission/Transfer Case, and Drive Axel. There is a $3,000 claims limit associated with this plan.

TruStage Auto Insurance

As a member of Associated Healthcare Credit Union, you could enjoy discounted rates combined with online convenience and 24/7 claims service.

Get your free quote today by using the link below or by calling the Liberty Mutual direct response center at 1.888.380.9287.

Auto and Home Insurance is offered by TruStage Insurance Agency, LLC and issued by leading insurance companies. Discounts are not available in all states and discounts vary by state. The insurance offered is not a deposit and is not federally insured. This coverage is not sold or guaranteed by your credit union. MAH-1112-7C9E