VISA® Credit Cards

The Best Card to Have in Your Wallet!

As of June 4, 2024, the average interest rate for a new credit card in the United States is 24.80% APR*. With AHCU, you can enjoy rates up to 10% lower, and even 20% lower with our 2.99% introductory rate.

If you want a credit card with no annual fee and the most competitive interest rate, look no further than Associated Healthcare Credit Union.

2.99% APR* Introductory Rate

Open a new VISA credit card from AHCU and pay only 2.99% APR* for the first 6 months on all purchases and balance transfers completed within the first 60 days.

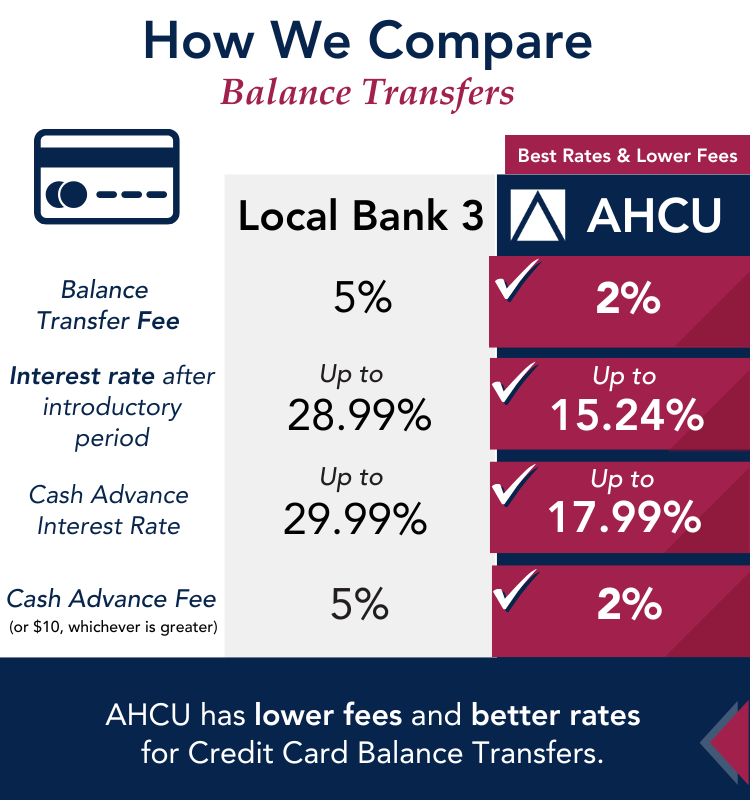

Save More with AHCU’s Lower Fees & Better Rates!

Looking to transfer your credit card balance? We offer some of the lowest fees and best interest rates compared to local banks. With balance transfer fees as low as 2% and interest rates significantly lower than competitors, you can save more and pay off debt faster. Switch to AHCU today!

* APR = Annual Percentage Rate. 2.99% APR does not apply to balance transfers or cash advances.

Compare and Discover the Right Card for You

Find the perfect AHCU VISA credit card to fit your needs.

VISA PREMIER

Premier Card Benefits

-

Introductory Offer: 2.99% APR* for the first 6 months on all purchases and balance transfers completed within the first 60 days.

- Rates as low as 13.24% APR*

- No annual fee

- Limit $300 to $25,000

- EMV Chip Technology

- Contactless Technology

- Visa Zero Liability Program

- Travel Accident Insurance

- Travel Baggage Delay Insurance

- Roadside Dispatch

- ID Navigator Powered by Norton LifeLock

VISA SIGNATURE REWARDS

Signature Card Benefits

- Introductory Offer: 2.99% APR* for the first 6 months on all purchases and balance transfers completed within the first 60 days.

- Earn 20,000 points for $2,000 net purchases in the first 90 days of receiving your card

- Rates as low as 15.24% APR*

- No annual fee

- Limit $5,000 to $25,000

- Visa Signature Offers + Perks

- Priority Member Service Calls

- Travel and Emergency Assistance Services

- EMV Chip Technology

- Contactless Technology

- Visa Zero Liability Program

- Travel Accident Insurance

- Travel Baggage Delay Insurance

- Roadside Dispatch

- ID Navigator Powered by Norton LifeLock

Rewards Point Program Details

Make your card work for you. Get the VISA Signature Rewards card, and earn rewards points on your purchases to spend as you wish.

- Earn 20,000 points for $2,000 net purchases in the first 90 days of receiving your card

- Earn 1.5 points for every $1 spent

- Earn 2 points for every medical purchase*

- Choose your Reward type:

- Cash Back

- Travel

- Merchandise

- Gift Cards

- Charitable donations (choose between Allina Foundation and Children's MN Foundation)

* Merchant must report to Visa with a medical Merchant Category Code.

* APR = Annual Percentage Rate. 2.99% APR does not apply to balance transfers or cash advances.

Find Peace of Mind with the AHCU Card Manager App

With the AHCU Card Manager app, you have full control over your card’s security. Instantly freeze your card if it goes missing, unfreeze it when found, or report it as lost.

Plus, you can easily report disputed purchases without waiting on hold. Stay in control and ensure your card is always safe.

Pay As You Go with VISA Installment Payments

AHCU now offers installment plans to help you pay off larger purchases faster and with less interest.

Easily manage big credit card purchases with our Installment Payment plan, available through the Card Manager app. Prioritizing your financial wellness, this feature ensures you stay on top of your finances effortlessly.

How It Works:

- You’ll be notified through the AHCU Card Manager app when you make a qualifying purchase.

- Choose between 3 and 18 monthly payments, split evenly over the term.

- The app will inform you of the annual interest rate for your purchase.

- Confirm or decline the offer directly in the app – you’re in control.

Associated Healthcare Credit Union may change APRs, fees and other account terms in the future based on your experience with Associated Healthcare Credit Union and its affiliates as provided under the Card member Agreement and applicable law. Account must be open and in good standing to earn and redeem rewards and benefits. Upon approval, please refer to the Associated Healthcare Credit Union Installment Payments or the AHCU Card Manager App for additional information. Purchase must be greater than $100 from qualifying merchants. Interest rate will be provided via the Associated Healthcare Credit Union Card Manager App and will be contingent on qualifying purchase.

Tips to Boost Credit Scores and Pay Down Debt

With these strategies and AHCU’s Visa Credit cards by your side, you are well on your way to maximizing your financial wellness. Feel free to share these helpful tips with family members and co-workers.

Build Your Credit Score

- Pay On Time, Every Time.

Ensure you pay at least the minimum due on your cards and loans without delay. - Keep Your Balances Low.

Aim to use less than 30% of your available credit to show you can manage your credit well. - Hold Onto Good History.

The longer you maintain accounts in good standing, the better for your score. - Apply Sparingly.

Only open new accounts when necessary. Too many inquiries can negatively impact your score. - Check Your Reports Regularly.

Review your credit reports for errors that could be hurting your score and dispute any inaccuracies.

Pay Off Credit Card Debt Faster

- Craft a Budget.

Understanding where your money goes each month can help you cut unnecessary expenses. - The Snowball Method.

Start by paying off smaller debts first to build momentum, then tackle the larger ones. - Consider a Balance Transfer.

Transferring high-interest debt to a lower interest credit card can reduce the amount of interest you pay. - Spend Mindfully.

Seek Lower Interest Rates: Contact your credit card issuer to negotiate a lower interest rate on your existing balances. Even small charges can add up, consider pausing and reflecting before each purchase. - Extra Income, Extra Payments.

Any additional income—from overtime, bonuses, or gifts —should go towards paying down your debt faster.

AHCU is here for you for your lifetime financial journey. You are unique and we are with you every step of the way.