Individual Retirement Accounts (IRAs)

Secure your future with an Individual Retirement Account (IRA) at AHCU. Our IRAs not only help you save for retirement but also offer valuable tax benefits to maximize your investment.

Why Choose an IRA at AHCU?

Just like our other savings accounts, AHCU IRAs provide competitive dividends and minimal fees. You have the flexibility to invest in Certificates of Deposit (CDs) or Money Market accounts within your IRA, allowing you to strategize your retirement savings effectively.

IRA Options and Benefits

- Traditional and Roth IRA options: Choose the plan that best suits your financial goals.

- No Setup Fees: Start your retirement savings without any initial costs.

- No Monthly or Annual Maintenance Fees: Keep more of your money working for you.

- No Minimum Deposit to Open: Begin your savings journey with any amount.

- Expert Guidance: Consult with your tax advisor or visit the IRS website to understand your contribution limits and make informed decisions.

- Federally Insured by NCUA: Your funds are protected to at least $250,000, giving you peace of mind.

CD / IRA CD Rates

| Term | Rate | APY* |

|---|---|---|

| 6 Month | 2.47% | 2.50% |

| 12 Month | 2.72% | 2.75% |

| 18 Month | 2.96% | 3.00% |

| 24 Month | 3.20% | 3.25% |

| 36 Month | 3.20% | 3.25% |

|

48 Month (At least 100% new money) |

3.45% | 3.50% |

|

48 Month (At least 50% new money) |

3.20% | 3.25% |

|

48 Month (Less than 50% new money) |

2.96% | 3.00% |

| 60 Month | 3.20% | 3.25% |

|

7 Month Special (At least 100% new money) |

4.17% | 4.25% |

|

7 Month Special (At least 50% new money) |

3.92% | 4.00% |

|

7 Month Special (Less than 50% new money) |

3.69% | 3.75% |

|

14 Month Special (At least 100% new money) |

4.17% | 4.25% |

|

14 Month Special (At least 50% new money) |

3.92% | 4.00% |

|

14 Month Special (Less than 50% new money) |

3.69% | 3.75% |

| 12 Month Student | 2.96% | 3.00% |

The Minimum Balance required to open a regular Certificate is $1,000.

*APY = Annual Percentage Yield.

- A 90-day penalty of dividends applies to the 6 and 12 month certificate for early withdrawal. A 180-day penalty of dividends applies to the 14, 18, 22, 24, 36, 48 and 60 month certificates for early withdrawal.

- Terms listed are based on the required minimum deposit with all dividends paid quarterly to the certificate. The APY may vary if dividends are paid to any other account.

Money Market / IRA Money Market Rates

| Minimum | Rate | APY* |

|---|---|---|

| $2,500 | 2.47% | 2.50% |

| $50,000 | 2.72% | 2.75% |

| $100,000 | 2.96% | 3.00% |

| $200,000 | 3.20% | 3.25% |

- Dividends are compounded monthly for all money market accounts.

- Money Market accounts below $2,500 are assessed a $10 monthly fee and interest is not earned.

- All Money Market accounts with balances below $2,500 will earn 0.05% APY*.

*APY = Annual Percentage Yield.

If you are a current member, you can simply log into online banking, click (+) add account and then choose the type of savings account you want.

Understanding Your Options

- Traditional IRA: Contributions may be tax-deductible, and earnings grow tax-deferred until withdrawal.

- Roth IRA: Contributions are made with after-tax dollars, but earnings and withdrawals are tax-free if certain conditions are met.

- Coverdell ESA: Designed for education savings, offering tax-free growth and tax-free withdrawals for qualified educational expenses. A great option to give your children and grandchildren a head start.

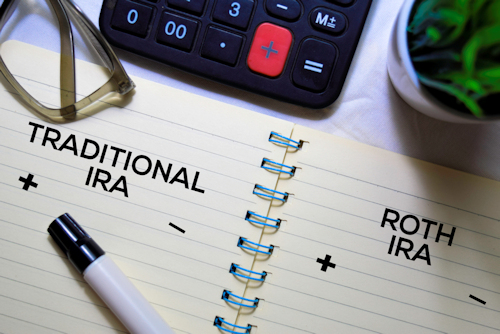

Traditional vs. Roth: Which Is for You?

Choosing between a Traditional and Roth IRA depends on when you want to receive the tax benefits. Each option has its own benefits, so consider your current and future financial situation to decide which is best for you.

TRADITIONAL IRA

Offers immediate tax relief. Your contributions may be tax-deductible, which can lower your taxable income today. However, you will pay taxes on your withdrawals during retirement.

- No income limits to open

- No minimum contribution requirement

- Contributions are tax deductible on state and federal income tax1

- Earnings are tax-deferred until withdrawal (when usually in the lower tax bracket)

- Withdrawals can begin at age 59½

- Early withdrawals are subject to penalty2

- Mandatory withdrawals at age 72

- No age limit on making contributions as long as you have earned income

ROTH IRA

Provides future tax benefits. Contributions are made with after-tax dollars, so they don’t reduce your taxable income now. The major advantage comes at retirement, as your withdrawals (including earnings) are tax-free, provided certain conditions are met.

- Income limits to be eligible to open Roth IRA3

- Contributions are NOT tax-deductible

- Earnings are 100% tax-free at withdrawal1

- Principal contributions can be withdrawn without penalty1

- Withdrawals on interest can begin at age 59½

- Early withdrawals on interest are subject to penalty2

- No mandatory distribution age

- No age limit on making contributions as long as you have earned income

1 Subject to some minimal conditions. Consult a tax advisor.

2 Certain exceptions apply, such as healthcare, purchasing a first home, etc.

3 Consult a tax advisor.

Coverdell ESA Student Savings

Coverdell ESAs can be used for more than college and universities. They can be used for elementary, secondary, vocational, and special education schools.

A Coverdell ESA can pay for a wide range of educational expenses, including:

- Tuition and Fees: Payments for enrollment or attendance at an eligible educational institution.

- Books and Supplies: Costs for textbooks, notebooks, and other necessary supplies.

- Technology: Expenses for computers, software, and internet access, if used primarily for educational purposes.

- Room and Board: Costs for housing and meal plans, if the student is enrolled at least half-time.

- Special Needs Services: Expenses required for a special needs beneficiary to attend school.

Start saving today for the special children and grandchildren in your life today. They will appreciate you giving them a head start.

- Set aside funds for education

- No setup or annual fee

- Dividends grow tax-free

- Withdrawals are tax-free and penalty-free when used for qualified education expenses1

- Designated beneficiary must be under 18 when contributions are made

- To contribute to an ESA, certain income limits apply2

- Contributions are not tax deductible

- $2,000 maximum annual contribution per child

- The money must be withdrawn by the time he or she turns 303

- The ESA may be transferred without penalty to another member of the family

1 Qualified expenses include tuition and fees, books, supplies, board, etc.

2 Consult your tax advisor to determine your contribution limit.

3 Those earnings are subject to income tax and a 10% penalty.