Simple Financial Moves That Can Help Lighten the Load.

Financial stress can slip in between shifts, paperwork, and everything else that keeps your day running. And with economic headlines changing week to week, that background tension can build fast.

Small, intentional steps can create real breathing room. Whether you’re caring for patients, managing billing, or keeping the household steady while a partner pulls doubles, here are a few ways to ease the pressure.

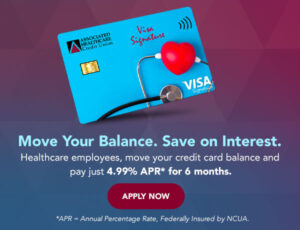

1. Cut Credit Card Interest with a Balance Transfer

By moving high-interest credit card debt to a card with a low-rate introductory offer, more of your payment chips away at what you actually owe instead of disappearing into interest.

It’s best to have a payoff plan that keeps in mind when the promotional period ends. For example, if you can knock out the balance in six months, a balance transfer can save you hundreds that could go toward an emergency fund, childcare, or just a little less tightness at the end of the month.

2. Simplify Multiple Payments Through Debt Consolidation

If you’re tracking due dates from student loans, a car payment, and credit cards, a consolidation could bring relief. It combines those balances into one loan with one monthly payment, often at a lower interest rate.

Fewer bills to manage means fewer things slipping through the cracks when you’re running on four hours of sleep. It’s not the right move for everyone, but if the mental load of multiple payments is wearing you down, it’s worth a conversation.

Need a tool to help manage and tackle your debt? Watch this video below to see how to use a debt tracker.

3. Lower Your Monthly Loan Payments by Refinancing

If you borrowed money when rates were higher or if your credit has improved since you first took out the loan, then refinancing with an unsecured personal loan, like our Scholar Loan, could lower your monthly payment and free up cash for other priorities.

Whether refinancing makes sense depends on your situation. Consider how much time is left on each loan, any fees involved, and whether the monthly savings justify the change. These are details we can help you work through.

4. Keep More of Your Money With the Right Checking Account

Get matched with a checking account that works in your favor. Select an account based on what matters to you:

- Dividend Checking pays higher rates on your account balance each month.

- Cash Back Checking lets you earn with each debit card transaction, making the most of everyday spending.

- EZ Checking helps you avoid an annual debit card fee by simply using the card once a year.

AHCU Checking Account Comparison

| Account Type | DIVIDEND CHECKING | CASH BACK CHECKING | EZ CHECKING |

| Monthly Maintenance Fee | None | None | Must have a debit card and enroll in electronic statements to avoid a $4.95 monthly fee. |

| Minimum Balance Fee | None | None | None |

| Free Online & Mobile Banking | Yes | Yes | Yes |

| Free Contactless Debit Card? | Yes | Yes | Yes. Requires one purchase per year to avoid a $10 annual debit card fee. |

Plus, all AHCU checking accounts include:

- Early direct deposit (up to TWO days earlier)

- Free use of Zelle®

- Apple Pay, Google Pay & Samsung Pay

- Unlimited check writing

Because AHCU is member-owned, we don’t answer to shareholders. This means better rates and fewer fees for you.

5. See Your Full Financial Picture With a Wellness Checkup

A Financial Wellness Checkup is a real conversation with an AHCU team member about where you are and where you’d like to be. We’ll look at your full picture: existing debt, savings balance, your short- and long-term financial goals, and the options that actually fit your life.

Schedule your Financial Wellness Checkup by giving us a call, stopping by one of our five Minnesota locations, or connecting online. We’re here when you’re ready.