Home Loans

In partnership with Servion Mortgage Group, we offer financing for first homes, second homes, and vacation properties. From condos to multi-family homes, we make the process simple and prioritize your financial success.

Your Dream Home Starts Here

Home Solutions Tailored to Your Lifestyle Through Our Partnership with Servion

Through our partnership with Servion, we’re able to offer our members a full range of home loan solutions with the same personalized service you trust from your credit union.

Whether you’re buying your first home, upgrading, downsizing, or purchasing your dream vacation home–we make financing seamless.

From Conventional, FHA, VA USDA and more, our partnership with Servion gives you access to competitive rates, flexible options and the guidance of local lending experts who put your financial goals first.

Home Purchasing & Refinancing

AHCU partners with Servion to offer home purchase and refinancing solutions tailored to your needs. Whether you want to lower your payment, shorten your term, or access home equity, their experts make the process simple and stress-free. Members benefit from competitive rates, flexible options, and personalized support at every step.

Benefits of a Mortgage Provided By Servion

- Competitive rates

- 1st Time Homebuyer Program

- Flexibility — Available for primary residence, second homes, vacation properties and multi-family homes

- Free pre-approval

- Quick decision-making and processing

- Knowledge about the local real estate market

NMLS#: 808383

Multiple Financing Programs

We can help you find the financing program that best suits your needs. Your Mortgage options include:

- Non-Conforming ARMS

- Conventional Loans

- Jumbo Loans

- USDA Loans

- FHA Loans

- VA Loans

NMLS#: 808383

TruStage Home Insurance

The TruStage™ Auto & Home Insurance Program provides affordable top-quality protection.

As a member of Associated Healthcare Credit Union, you could enjoy discounted rates combined with online convenience and 24/7 claims service.

Contact the Liberty Mutual direct response center by telephone at 1.888.380.9287 or by using the button below.

TruStage Auto and Home Insurance program is offered by TruStage Insurance Agency, LLC and issued by leading insurance companies. Discounts are not available in all states and discounts vary by state. The insurance offered is not a deposit and is not federally insured. This coverage is not sold or guaranteed by your credit union. MAH-1112-7C9E

Ready to make your home ownership dreams a reality?

Click the button below to begin your home purchasing or refinance process today!

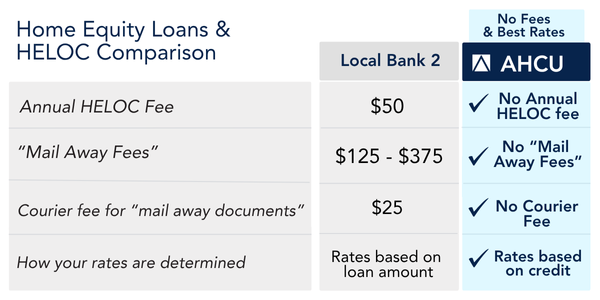

Flexible HELOC Loans from AHCU

AHCU offers in-house HELOC (Home Equity Line of Credit) loans, giving members flexible access to their home’s equity. Whether it’s for home improvements, debt consolidation, or other major expenses, our team works with you directly to provide competitive rates and personalized guidance. With AHCU, the process is simple, convenient, and designed around your financial goals.

Benefits to AHCU Home Equity Loans

A Home Equity loan offers competitive rates for several short-term or one-time needs such as:

- Education expenses

- Major life events

- Home remodel projects

- Debt consolidation

- And much more

The existing equity in your home is used as collateral backing. There is no prepayment penalty, and interest paid might be tax deductible*.

You can opt to receive funds in one lump sum, or apply for a Home Equity Line of Credit (HELOC) loan.

*Consult a tax advisor.

Pay Off Credit Card Debt

You can also use a Home Equity Loan to pay off high-interest credit cards. See the example below.

| Credit Card | Home Equity Loan | |

|---|---|---|

| Balance | $15,000 | $15,000 |

| APR* | 27.79%** | 6.90%*** |

| Years to Pay Off | 5 | 5 |

| Monthly Payment | $465.14 | $296.31 |

| Interest Paid | $12,908.33 | $2,715.11 |

* APR is Annual Percentage Rate

** Average national credit card rate according to Forbes Advisor’s weekly credit card rates report, Jan. 15, 2024

*** As low as 6.90% APR

Home Equity Rates

Home Equity Line of Credit Loans1

| Terms | APR* |

|---|---|

| Up to 80% LTV | 7.00% (Prime plus 0.25%) |

| 81-100% LTV | 8.50% (Prime plus 1.75%) |

1Variable rate based on Prime as published in WSJ. (Min 3.50% and will not exceed a cap of 12%)

Fixed Rate Home Equity Loans

| Term | Type | APR* |

|---|---|---|

| 5 year (Up to 15-year available) | 1st Position, Up to 80% LTV** | 5.50% |

| 5 year (Up to 15-year available) | 81%-100% LTV** | 7.20% |

*APR = Annual Percentage Rate.

** LTV is the loan to value ratio and factor determines daily periodic rate for loans.

Home Equity Rates

FIXED RATE LOANS**

| Up to 80% LTV |

|---|

| 5 Years - As low as 5.50% APR* |

| 10 Years - As low as 5.75% APR* |

| 15 Years - As low as 6.00% APR* |

| 81-100% LTV (appraisal required) |

|---|

| 5 Years - As low as 7.20% APR* |

| 10 Years - As low as 7.50% APR* |

| 15 Years - As low as 8.00% APR* |

LINE OF CREDIT**1

| Up to 80% LTV |

|---|

| Up to 15 years; Min $10,000 - Max $250,000; 7.00% APR* (Prime plus 0.25%) |

| 81-100% LTV |

|---|

| Up to 15 years; Min $10,000 - Max $250,000; 8.50% APR* (Prime plus 1.75%) |

*APR = Annual Percentage Rate.

** Closing costs may vary dependent on the loan amount and individual terms of the Home Equity Loan. Larger amounts are available to qualified borrowers.

1 Variable rates are based on prime as published in the Wall Street Journal. Rates are subject to change monthly with a floor of 4% and will not exceed a cap of 12%.

If You Are Already a Member

Current members can simply log into online banking, click (+) add account and then choose the Home Equity loan option you need.

On-Demand Home Buying Education, for FREE

- Budgeting to purchase a home

- The home buying process

- Home inspections

- Closing costs

- How your credit score impacts your ability to purchase a home

- And much more

Best of all, these resources are all absolutely free to AHCU members.